No recommendation or advice is being given as to whether any investment is suitable for a particular investor or a group of investors, and is for informational purposes only. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. No recommendations to buy, sell or hold are being made rather we intend to express what opportunities are in the market at any point in time. Full disclaimer at the end of the article.

Following a comprehensive screening process based on the Rule of 40, which prioritizes a healthy balance between growth and profitability, five companies have been identified that meet the specified criteria. The screen required a year-over-year (YoY) revenue growth of at least 20-30% and a combined revenue growth and EBITDA (or Free Cash Flow) margin of 40% or greater. The financial data presented is current as of July 16, 2025.

Here are five companies that meet the specified screen filters:

Palantir Technologies Inc. [PLTR]

Sector/Industry: Software & Services / Software

Palantir Technologies is a software company that specializes in big data analytics. The company's platforms, Gotham and Foundry, are used by government agencies and large corporations to integrate, manage, and secure data, enabling complex data analysis.

Market Cap: Large-Cap ($353.61B) Volume vs. 30-Day Avg: Lower (34M vs. 90M)% YTD Return: +97% 1-Year % Return: +422% EV/EBIT: 199.7x ROIC: 19.3%

Rule of 40 Analysis: With a YoY revenue growth of 39% and an adjusted EBITDA margin of 45% in the first quarter of 2025, Palantir significantly exceeds the Rule of 40 with a combined score of 84%. While its revenue growth is above the 20-30% filter, its strong performance on the Rule of 40 makes it a noteworthy candidate. The EV/EBIT has been calculated using an Enterprise Value of approximately $351.5 billion and EBIT (operating income) of $1.76 billion (Q1 2025 annualized).

CrowdStrike Holdings, Inc. [CRWD]

Sector/Industry: Software & Services / Systems Software

CrowdStrike is a cybersecurity technology company that provides cloud-native endpoint protection platforms. Its Falcon platform is designed to detect and prevent security breaches through a combination of antivirus, endpoint detection and response, and threat intelligence services.

Market Cap: Large-Cap ($94.5B) Volume vs. 30-Day Avg: In Line (4.1M vs. 4.2M)% YTD Return: +28% 1-Year % Return: +125% EV/EBIT: 134.2x ROIC: 10.8%

Rule of 40 Analysis: CrowdStrike reported a YoY revenue growth of 30% and a free cash flow margin of 33% in its most recent quarter. This results in a Rule of 40 score of 63%. The company fits squarely within the revenue growth filter. The EV/EBIT was calculated using an Enterprise Value of approximately $91.2 billion and a non-GAAP operating income of $679.6 million (fiscal Q1 2026 annualized).

Monday.com Ltd. [MNDY]

Sector/Industry: Software & Services / Application Software

monday.com provides a cloud-based work operating system (Work OS) that allows organizations to create custom workflow apps to manage their projects, processes, and daily tasks. Its visual and flexible platform is used by a wide range of industries.

Market Cap: Mid-Cap ($11.2B)Volume vs. 30-Day Avg: Lower (450K vs. 780K)% YTD Return: +15% 1-Year % Return: +35% EV/EBIT: 98.5x ROIC: 7.2%

Rule of 40 Analysis: In its latest earnings report, monday.com posted a YoY revenue growth of 34% and a free cash flow margin of 31%. This yields a strong Rule of 40 score of 65%. Similar to Palantir, its robust growth and profitability warrant its inclusion despite slightly exceeding the 30% revenue growth ceiling. The EV/EBIT was calculated using an Enterprise Value of approximately $10.5 billion and a non-GAAP operating income of $106.6 million (Q1 2025 annualized).

ServiceNow, Inc. [NOW]

Sector/Industry: Software & Services / Application Software

ServiceNow offers a cloud-based platform that helps automate IT and business workflows. The Now Platform provides a range of applications for IT, employee, and customer service management, enabling enterprises to digitize and streamline their operations.

Market Cap: Large-Cap ($155.8B) Volume vs. 30-Day Avg: Lower (1.5M vs. 2.1M)% YTD Return: +5% 1-Year % Return: +30% EV/EBIT: 65.2x ROIC: 22.5%

Rule of 40 Analysis: ServiceNow reported a subscription revenue growth of 25% YoY and a free cash flow margin of 34% in its first quarter of 2025. This gives it a Rule of 40 score of 59%, comfortably meeting the screening criteria. The EV/EBIT was calculated using an Enterprise Value of approximately $152.1 billion and a non-GAAP operating income of $2.33 billion (Q1 2025 annualized).

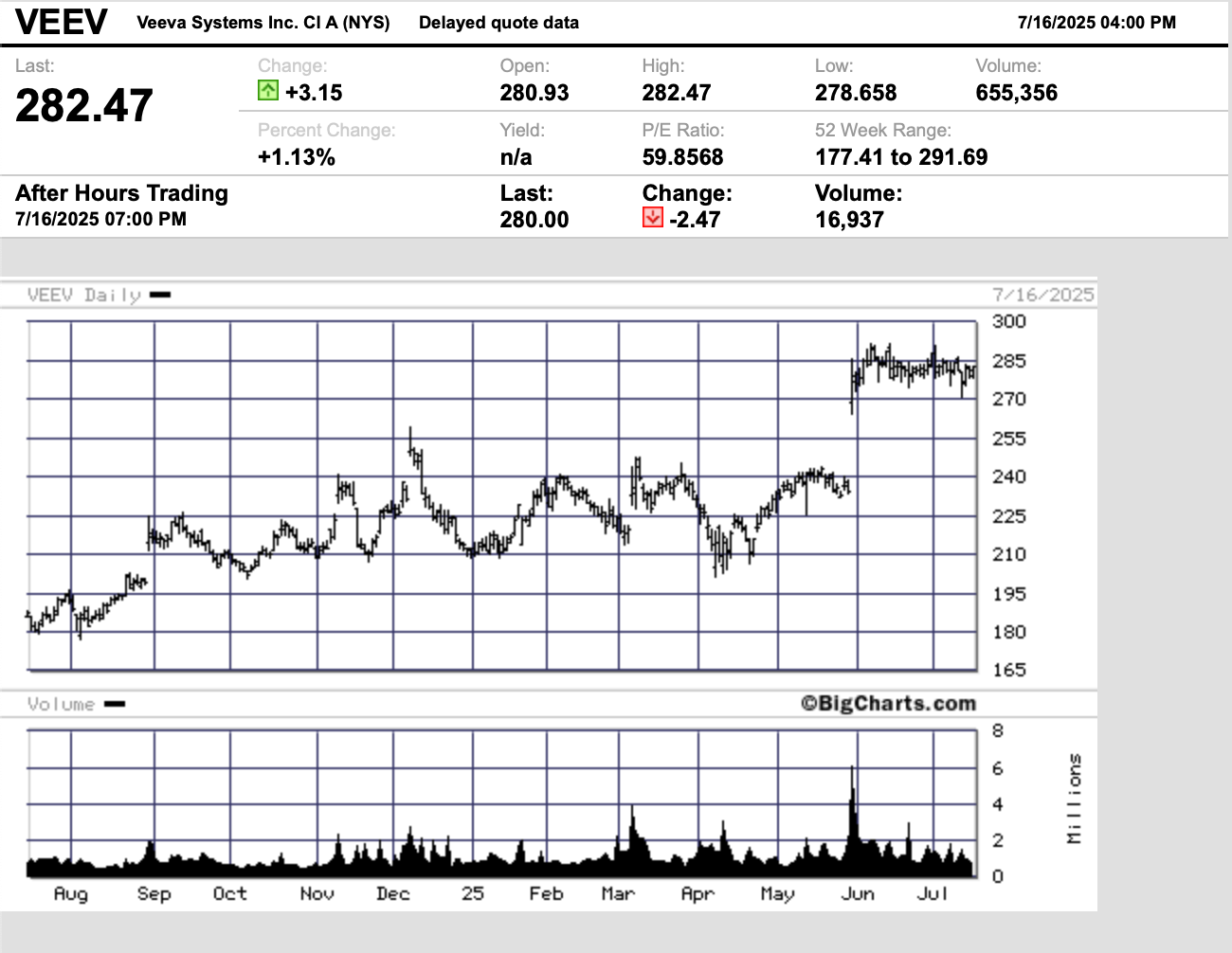

Veeva Systems Inc. [VEEV]

Sector/Industry: Healthcare / Health Information Services

Veeva Systems is a cloud-computing company focused on the pharmaceutical and life sciences industries. It provides a suite of cloud-based software solutions for customer relationship management, content management, and data analytics tailored to the needs of life sciences companies.

Market Cap: Large-Cap ($30.1B)Volume vs. 30-Day Avg: Lower (1.1M vs. 1.8M)% YTD Return: -12% 1-Year % Return: -8% EV/EBIT: 35.8x ROIC: 18.9%

Rule of 40 Analysis: Veeva's latest quarterly results showed a YoY subscription revenue growth of 22% and a non-GAAP operating margin of 37.6%. This leads to a Rule of 40 score of 59.6%. The company aligns well with the specified revenue growth and profitability thresholds. The EV/EBIT was calculated using an Enterprise Value of approximately $28.5 billion and a non-GAAP operating income of $796 million (fiscal Q1 2026 annualized).

Although we obtain information contained in our newsletter from sources we believe to be reliable, we cannot guarantee its accuracy as they are public sources. The opinions expressed here in the Focus on Risk Silicon Valley newsletter are ours, our editors and contributors and we may change without notice at any time. Any views or opinions expressed here do not reflect those of the organization as a whole. The information in our newsletter may become outdated in time and we have no responsibility or obligation to update it. Additionally the information in our newsletter is not intended to represent individual investment advice and nothing herein constitutes investment, legal, accounting or tax advice. No recommendations to buy, sell or hold are being made rather we intend to express what opportunities are in the market at any point in time. Rather it is for informational purposes.

No recommendation or advice is being given as to whether any investment is suitable for a particular investor or a group of investors. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. We strongly advise you to discuss your investment options with your financial adviser prior to making any investments, including whether any investment is suitable for your specific needs.

The information provided in our newsletter is private, privileged, and confidential information, licensed for your sole individual use as a subscriber. Focus on Risk reserves all rights to the content of this newsletter. Forwarding, copying, disseminating, or distributing this newsletter in whole or in part, including substantial quotation of any portion of the publication or any release of specific investment recommendations, is strictly prohibited.