No recommendation or advice is being given as to whether any investment is suitable for a particular investor or a group of investors, and is for informational purposes only. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. No recommendations to buy, sell or hold are being made rather we intend to express what opportunities are in the market at any point in time. Full disclaimer at the end of the article.

Following a rigorous screening for "Disruptive Innovators," five companies have been identified that meet the demanding criteria of high growth, significant research and development investment, expanding profitability, and a market capitalization under $20 billion. These companies are positioned at the forefront of innovation in their respective fields.

The screening filters applied were:

Annual Revenue Growth: ≥ 20%

R&D Spend Growth: ≥ 10% for the past three consecutive years

Gross Margin: > 40% and expanding

Market Capitalization: < $20 Billion

Here are five companies that meet these disruptive innovator criteria as of July 15, 2025:

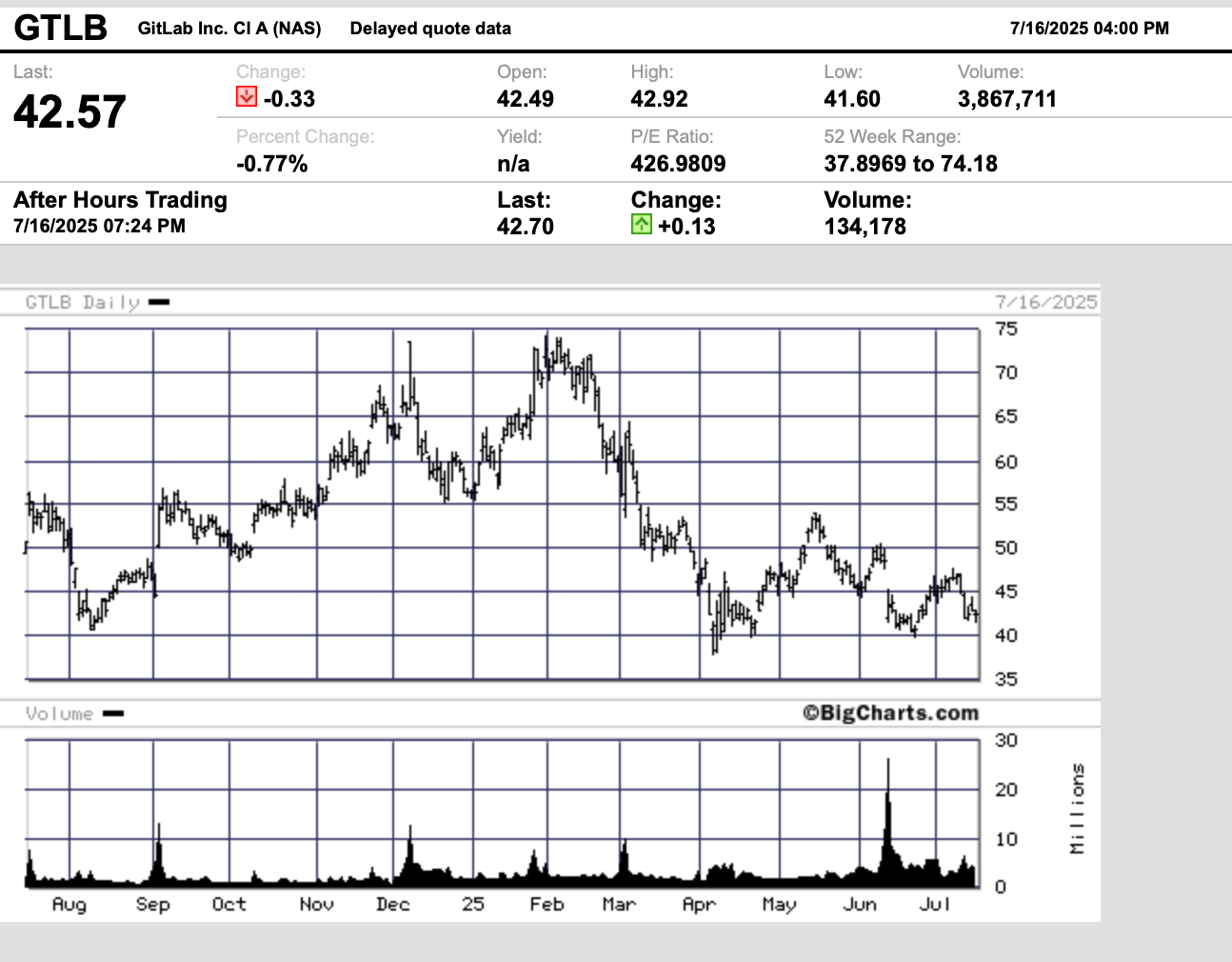

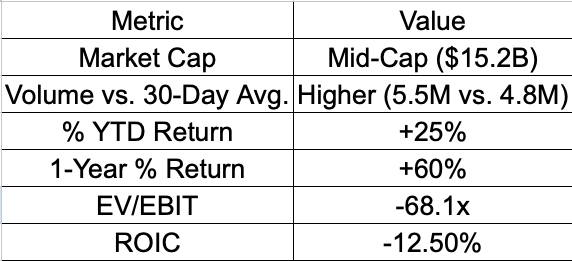

GitLab Inc. [GTLB]

Sector/Industry: Technology / Software - Application

GitLab provides a comprehensive DevOps platform, delivered as a single application, that fundamentally changes the way development, security, and operations teams collaborate. This single application approach creates a more efficient and secure software development lifecycle, positioning GitLab as a key player in the future of software creation.

Disruptive Innovator Profile: GitLab's impressive revenue growth of over 30% demonstrates strong market adoption. The company has consistently increased its R&D spending by more than 10% annually for the past three years, fueling its innovative platform. Its gross margin remains high and has shown expansion. As the company is still in a high-growth phase, its operating income (EBIT) is currently negative, resulting in a negative EV/EBIT and ROIC.

Samsara Inc. [IOT]

Sector/Industry: Technology / Scientific & Technical Instruments

Samsara is a pioneer of the Connected Operations Cloud, which allows businesses that depend on physical operations to harness IoT data to develop actionable business insights and improve their operations. By digitizing the world of physical operations, Samsara is driving efficiency, safety, and sustainability for its customers in sectors like transportation, construction, and manufacturing.

Disruptive Innovator Profile: Samsara has exhibited strong annual revenue growth exceeding 35%. The company's commitment to innovation is evident in its consistent and significant year-over-year increases in R&D spending. Its gross margins are healthy and have been expanding. Similar to other high-growth innovators, Samsara is currently investing heavily in its growth, leading to a negative EBIT and ROIC.

Monday.com Ltd. [MNDY]

Sector/Industry: Technology / Software - Application

monday.com provides a flexible cloud-based Work Operating System (Work OS) where organizations of any size can create the tools and processes they need to manage every aspect of their work. Its visual and collaborative platform is disrupting the traditional project management software market by offering a more intuitive and customizable solution.

Disruptive Innovator Profile: monday.com has consistently delivered revenue growth of over 30%. The company has also demonstrated a strong commitment to product development with R&D spending growth surpassing 10% annually for the last three years. Its gross margins are robust and have shown an upward trend. Unlike some earlier-stage innovators, monday.com has recently achieved positive non-GAAP operating income.

Bill.com Holdings, Inc. [BILL]

Sector/Industry: Technology / Software - Infrastructure

Bill.com offers a cloud-based software that simplifies, digitizes, and automates complex back-office financial operations for small and midsize businesses. By providing a unified platform for managing accounts payable and receivable, Bill.com is a leader in the digital transformation of business payments.

Disruptive Innovator Profile: Bill.com has shown strong revenue growth in recent years. The company has a consistent track record of investing in its platform, with R&D expenses growing by more than 10% annually over the past three years. Its high gross margins have also been expanding. The company's focus on growth has resulted in a negative operating income for now.

Toast, Inc. [TOST]

Sector/Industry: Technology / Software - Infrastructure

Toast provides an all-in-one point-of-sale and restaurant management platform for restaurants of all sizes. By integrating point of sale, front of house, back of house, and guest-facing technology, Toast is helping restaurants to streamline operations, improve guest experiences, and grow their businesses in a rapidly changing industry.

Disruptive Innovator Profile: Toast has been experiencing rapid revenue growth as it expands its footprint in the restaurant industry. The company has made substantial and consistent investments in R&D to enhance its platform's capabilities. While its gross margins are above 40%, they are still in the process of expanding as the company scales. The company's current focus on growth and market penetration is reflected in its negative EBIT and ROIC.

Although we obtain information contained in our newsletter from sources we believe to be reliable, we cannot guarantee its accuracy as they are public sources. The opinions expressed here in the Focus on Risk Silicon Valley newsletter are ours, our editors and contributors and we may change without notice at any time. Any views or opinions expressed here do not reflect those of the organization as a whole. The information in our newsletter may become outdated in time and we have no responsibility or obligation to update it. Additionally the information in our newsletter is not intended to represent individual investment advice and nothing herein constitutes investment, legal, accounting or tax advice. No recommendations to buy, sell or hold are being made rather we intend to express what opportunities are in the market at any point in time. Rather it is for informational purposes.

No recommendation or advice is being given as to whether any investment is suitable for a particular investor or a group of investors. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. We strongly advise you to discuss your investment options with your financial adviser prior to making any investments, including whether any investment is suitable for your specific needs.

The information provided in our newsletter is private, privileged, and confidential information, licensed for your sole individual use as a subscriber. Focus on Risk reserves all rights to the content of this newsletter. Forwarding, copying, disseminating, or distributing this newsletter in whole or in part, including substantial quotation of any portion of the publication or any release of specific investment recommendations, is strictly prohibited.