Executive Summary

Video games now earn more revenue than any other type of media, on PC, console, mobile, and elsewhere, with new game platforms in development such as VR and AR headsets. The newest video game platform is outdoor play, notably with Pokémon Go, which has earned $8 billion, and whose maker, Niantic, was just bought by Savvy Games for $3.5 billion.

However, unlike PC, console, and other game platforms, so far outdoor video games have been limited to a single type of gameplay: collecting stuff, which has weak economics. That leaves a blue sky opportunity for the company that brings more popular video game genres outdoors, the blockbuster game types from PC and console with the strongest revenue, such as action and roleplaying. Niantic’s technology for zero-dimensional scattered map points doesn’t support these genres. An entire landscape is needed, a continuous game area.

Monsarrat, a Los Angeles startup, is already doing it, led by Founder and CEO Johnny Monsarrat, who previously founded a division of Warner Bros. So far they have raised $2.7 million, built a demo game that’s been praised by fans and press, and attracted key advisors such as the former President of Blizzard. Monsarrat’s 6 patents lay a continuous game world across a real world space such as the player’s back yard or local park.

These new outdoor game types may be highly profitable because (a) they replicate proven economics from the most popular PC game genres (b) in the global crisis of loneliness, players are aching to get outside (c) as shown by sports like baseball where the game field never varies but repeat play is evergreen, real-world spaces and real-world friendships don’t get boring, so outside games should retain players longer than other video games. Monsarrat is now raising $10M to build their first game, with a B2B game development platform to follow. They plan to exit in 3 years during the market frenzy for AR technology as the tech giants release their future AR glasses.

Going Outdoors: A New Platform for Video Games

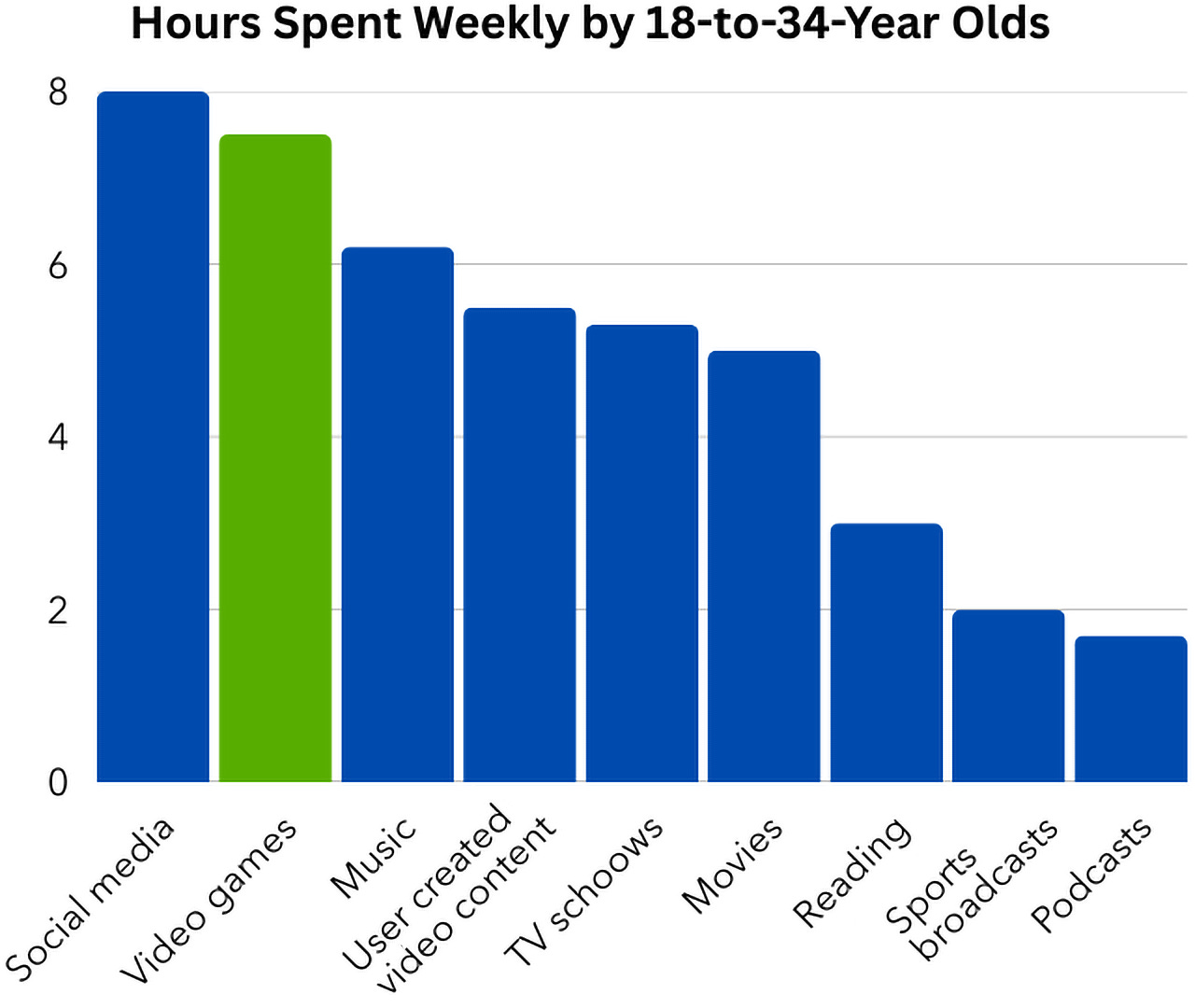

Video games now lead the entertainment industry, earning more than $180 billion in 2024, and being second only to social media as the most popular media activity of young people.

Video games are often broken into submarkets by distribution channel, with the major platforms being mobile games (on Android or iPhone), PC games (desktop PCs, laptops, and the Apple iMac), and consoles (including Xbox, PlayStation, and Nintendo).

Over the last decade a new platform has emerged: outdoor video games, also known as AR walking games. They were first pioneered by Niantic, the San Francisco company that launched global sensation Pokémon Go in 2016. Pokémon Go earned $250 million just in its first month, $8 billion to date, and continues to earn $500 million a year.

Outdoor video games are mobile phone games where players walk around outside. The game world is shown through augmented reality (AR), a fantasy world drawn on top of the real world view from the phone’s camera. No special hardware is needed.

So far, due to technology limitations, outdoor games have only had one type of gameplay: collecting things. Pokémon Go is still the best known and most successful, but other hit outdoor collecting games include Dragon Quest Walk (COLOPL and Square Enix, $2B in revenue), Jurassic World Alive (Jam City, $180M), Let’s Hunt Monsters (Tencent, $150M), and Monster Hunter Now (Niantic, $150M).

Overall, outdoor collecting games earn nearly $1 billion / year, made popular because:

In the global crisis of loneliness, people ache to get outside and feel connected,

AR is a magic-seeming technology that puts fantasy creatures into the real world,

It’s an outside alternative to sports that is more creative and less athletic,

Walking lifts up a player’s body chemistry; it literally makes people happy, and

Billions of dollars of investment by tech giants, driving mainstream adoption of AR technology and making easy developer tools available, all without any need for an AR headset.

In 2025, outdoor video games are at a turning point. Last month, Niantic sold its games division to Scopely, a subsidiary of Savvy Games Group, for $3.5 billion. This generates a return for investors and puts Pokémon Go and other games into the hands of a more established video game publisher. It is one of the largest video game industry M&As in the last 5 years, proving that outdoor video games are here to stay, a powerful new platform for video games that has already outpaced VR games.

Market Challenges

Outdoor video games have also met challenges. The acquisition of Niantic’s game division exposes the limits of Niantic’s strategy and technology. Niantic was born out of Google Maps and is more of a tools company than a games company. After the success of Pokémon Go, Niantic failed to expand in new strategic directions, with their only other hit game, Monster Hunter Now, being a clone of Pokémon Go. Their new owner, Scopely, is expected to treat Pokémon Go and Niantic’s other games as an asset, marketing them better than Niantic but not innovating. So simultaneously the sale shows the need for fresh approaches in outdoor video games, while taking an innovator off of the board.

Niantic’s main problem with growth was their type of gameplay. Outdoor video games so far have all been “collecting” games, an unpopular genre. Who plays collecting games on PC or console? Collecting games have weak economics: players collect the easy-to-find items quickly, and then gameplay becomes a grind as they slowly hunt down rare items. So although Pokémon Go and similar games have earned $10B, they did it “walking against the wind”, with poor KPIs on a per-player basis. Collecting games have weak player retention and monetization. Players quit. They do not stay and spend.

In other words, outdoor video game play magnifies at-home play. If even the weakest genre from PC can be a blockbuster outdoors, how much more could actual PC blockbuster genres earn outside?

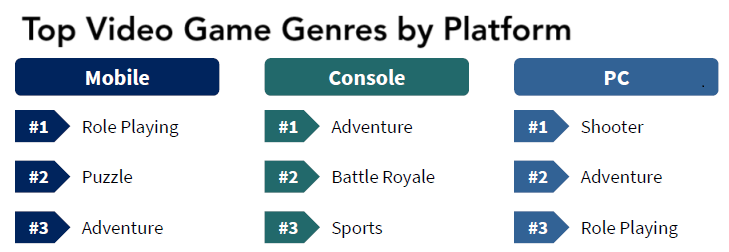

Other video game platforms such as PC and console of course have dozens of different game types. The genres with the strongest and most proven economics are action, roleplaying, and adventure.

But these games are not supported by Niantic’s technology of scattered GPS points. You can’t put a racing car game onto a map point. There’s no room to explore a fantasy roleplaying world on a map point. You can’t shoot your way through an enemy base in an action game on a map point. To put these blockbuster PC game genres outside requires a continuous game zone that you can walk around.

So far market players have not supported this because of:

Overinvestment into their technology for scattered map points, which they would need to abandon to progress,

Niantic, the market leader, lacking a strategy because it has a tools culture instead of a games culture,

Every outdoor game maker, including Niantic, being star struck trying to replicate the success of Pokémon Go instead of innovating to new models.

Monsarrat’s New Strategy Could Energize the Market

Monsarrat is a new startup company, based in Los Angeles, and run by Founder and CEO Johnny Monsarrat, who previously founded a division of Warner Bros. Their thesis is that a technology for continuous outdoor game zones will push outdoor play beyond “collecting stuff” into a true game platform that could support every genre of play. All of the most popular video game genres have not been seen outdoors yet. From that perspective, the full potential of outdoor gaming is still untapped. In other words, Pokémon Go and its clones are just the beginning of what could be a much larger market.

With Monsarrat’s technology, players do not need to travel to a fixed location somewhere in their city. Instead they place a “game zone” outside anywhere they wish to play: a large park, a small park, or even their own backyard. Indoor gameplay is also possible, if there’s room to walk around.

So far the company has built an iconic team of game makers, won 6 patents, and launched a demo game, Landing Party. Landing Party has won praise in Forbes, VentureBeat, and Tom’s Guide, and is available now for iPhone and Android.

Monsarrat is now in partnership discussions to license a Hollywood franchise and raise $ to build the world’s first outdoor roleplaying game. During beta test they will partner with a video game publisher for marketing, or raise additional funds to self-publish. After the launch of this first game, Monsarrat will spin out a B2B game development technology so that others can make outdoor games.

Team

Monsarrat’s leaders have created new video game categories before.

Founder, CEO, and CTO Johnny Monsarrat co-invented Massively Multiplayer Online (MMO) gaming, now a $24 billion per year industry, as Founder, CEO, and CTO of Turbine, one of the “big three” first MMO companies. MMOs used the early Internet to form communities of game players. Turbine made “Game of the Year” Asheron’s Call, Dungeons & Dragons Online, and “Game of the Year” Lord of the Rings Online, and was bought by Warner Bros. for $160 million.

Chief Creative Officer Brian Sullivan co-invented real-time historical strategy games as co-founder of Ensemble Studios, which made Age of Empires, a $1B Microsoft game franchise. His games have sold over 25 million copies worldwide and won countless industry awards.

Advisors include Jack Tretton, the former CEO of PlayStation, Mike Ybarra, the former President of Blizzard Entertainment, David Anderman, the former COO of Lucasfilm, and Jenna Seiden, the former VP Business Development of Niantic (Pokémon Go).

Monsarrat is headquartered in Los Angeles with an in-house development team largely based in Warsaw, Poland. Many of its team are immigrants who came into Poland from war-torn Ukraine.

Technology

Monsarrat’s technology centers on adapting continuous game zones, which are ubiquitous in PC, console, and mobile video console games, to outdoor play. Its technology, including 6 fully granted patents:

Adapts a game mission to fit a real world space of any shape or size,

Allows players to move the game manually in real-time, to work around real world obstacles such as park benches and bushes,

Handles uneven ground in the real world or game world, and

Prevents players from cheating by walking through 3D game content, such as walking through the walls of a maze to escape.

This technology is key to the outdoor video game market because most players don’t live next to a large public park. They expect the game to work in a small nearby public park, or even in their own backyard or indoors. Monsarrat’s patents, which have broad claims, cover every way that continuous game zones can work smoothly in small spaces, and thus lock up the most popular and profitable game genres for outdoor play, which require such game zones.

Business Model

Monsarrat plans first to launch the world’s first outdoor roleplaying game, based on a Hollywood franchise currently in late stage talks.

User Acquisition will be driven by:

Paid social media marketing,

Monsarrat’s Hollywood partner marketing to their fan base,

Video game distribution partners outside the English speaking world,

The viral nature of playing a video game in a real world space such as a school playground or park, which gets noticed by your friends,

By giving players a route to earn money through the game as mission guides, thus giving them an incentive to promote the game, and

Because Monsarrat’s games take place outside, with real people in real spaces, they should be good for live video streaming on Twitch and YouTube gaming, another form of organic marketing.

Retention. Monsarrat could solve one of the biggest problems in video games: player retention. A video game maker has to spend money on advertisements to convince a player to download and try a video game. That’s expensive, so the video game must earn that money back and more. How long the average player stays and spends money is vital to the success of any game.

What a video game maker doesn’t want is to build expensive “content” (game missions, or game levels), to find that each new player burns through it quickly, playing each mission just once and then quitting the game or demanding more content. Instead, video game makers succeed when a small amount of content keeps players coming back repeatedly, for a long time. Monsarrat achieves this in two ways.

1. Real World Community. Monsarrat’s founder, Johnny Monsarrat, is already an expert in player retention, having previously pioneered Massively Multiplayer Online Games (MMOs). He was Founder, CEO, and CTO of Turbine, one of the “big three” original MMO game makers, now a division of Warner Bros. MMOs use an online community to increase player retention. If you want to see your friends, you have to keep playing the game. You feel loyalty and belonging by joining a team of players, and the team has weekly goals and needs your help, so you have to keep playing the game.

The more that players entertain each other, the less content you need to build to keep them coming back over and over. When Turbine’s game Asheron’s Call ended after 17 years, it was international news because it still had an active community of friends who wanted to spend time together. Two other Turbine games, Lord of the Rings Online and Dungeons & Dragons Online, are still going with active communities more than 18 years later.

These player retention factors that come from community should be even more powerful with the real world play in Monsarrat’s outdoor video games, because real world friendships are more valuable than online friendships. Monsarrat’s games will act as an icebreaker, a team-building exercise, bonding players together. Just as with sports or an escape room, moving around with someone helps you make new friends. That’s both a good deed and a huge revenue opportunity in the global crisis of loneliness, when people ache to feel connected to their neighborhoods and to others.

2. Physical Activity. Physical activity elevates your body chemistry and makes you happy. That’s why baseball, basketball, and other sports are infinitely repeatable. Sports teams don’t worry about making fresh “content” or new game levels. A football field, baseball field, and basketball court are always the same size and shape, but physical activity drives a mountain of repeat play. Athletes keep playing because they love moving around.

Even Pokémon Go proves this result. Pokémon Go famously has weak player retention, but actually its retention is excellent compared to its gameplay. It’s only a “collecting” game, an uninteresting and unpopular game genre not found anywhere else in video games. Who plays collecting games on PC or console? Players collect all the easy-to-find items first and then struggle to hunt around for the rare items. Collecting games get boring.

Yet, by adding a little walking around, Pokémon Go supercharged this weak game type. Relatively speaking, its player retention was actually excellent for its game type.

Monsarrat’s games aren’t based on weak gameplay. Their innovative technology, based on 6 fully granted patents, support continuous game zones outside for the first time, which are required for blockbuster, proven game genres from PC, console, mobile, and VR, like action and roleplaying. Outdoor play accelerated collecting games to new heights. It will accelerate these established game types with strong economics even further. So even with just a little game content, Monsarrat’s games could retain players at high multiples.

Monetization. Like most mobile games, Monsarrat’s games will be free to play, but earn revenue by selling things in the game:

Cosmetic items to dress up your game avatar and show off for your friends,

Useful items like a flaming sword to advance faster through game levels,

Or monthly subscriptions giving players access to special content and features, such as the ability to be matched with other players, inside tips, or to play more than 10 missions per day.

Additionally, Monsarrat plans to earn money by:

Sending players to restaurants and retail stores, a business model proven by Pokémon Go,

Allowing players to pay coaches who guide them through gameplay, with Monsarrat taking a cut,

and possibly in-game advertisements.

After its first game launches, Monsarrat will spin out a B2B game development platform to allow 3rd party game makers to build their own outdoor games. Monsarrat’s games do not require any special hardware, but as tech giants launch AR glasses in 2027 and 2028, that will cause a market frenzy for augmented reality that would be good timing for Monsarrat to seek an exit.

Competitive Position

Partnership and long term Strategy

Monsarrat’s technology has uses in many industries where a partnership could set up an acquisition:

Advertising Agencies. Monsarrat’s game development technology can build promotional mini-games. Such games would be unique and newsworthy because of the novel, never before seen gameplay. They would draw players into light physical activity that bonds them with the product or service being sold, and have the potential to go viral as other people see their friends walking in shared spaces with the promotional game on a phone.

AR hardware. Monsarrat’s games are arguably the “killer app” for forthcoming AR glasses such as Meta Orion. The typical use case for AR glasses is to sit still and use the glasses to replace a computer monitor or TV screen. Sitting still does not look interesting in advertisements, and AR glasses have easy substitutes: buyers may wonder, why do I need AR glasses when I could just use a computer monitor or TV screen? Monsarrat’s games, where players walk and laugh in a physical space, would look dynamic in AR glasses ads and are a use case where there is no substitute for the wide view of AR glasses.

AR Infrastructure. Much of the video game industry is not games, but B2B game middleware and supporting services such as monetization and analytics. Monsarrat’s future tools for video game developers could be acquired by a company like Unity that makes game development tools, or a tech giant such as Apple for inclusion into its own products.

Content makers. Video game makers and Hollywood studios seek to leverage their creative franchises and distribution channels by making video games. As a game studio, Monsarrat could partner with a video game maker for distribution, or a Hollywood studio to license creative IP, on the path to being acquired.

Content tools. Monsarrat’s AR experiences allow filmmakers to inexpensively create set designs and creatures, which actors can walk through and engage with, unlike green screens which are bulky to set up and where actors see nothing. Even a child could make a movie by walking around placing AR zombies across a school playground and then video recording friends escaping from or fighting them in the 3D AR game view.

Online Communities. In the global crisis of loneliness, people are exhausted by online-only relationships and crave to connect with people and places in the real world. Monsarrat’s games could bring communities like Instagram and Snap into the real world and help members make real world friendships, with the game acting like an icebreaker or team-building activity. Monsarrat’s games with real players in real spaces generate great video for social media.

Sports / Concert Arenas. At an arena, Monsarrat’s games give fans a new way to socialize and meet new people, and can drive players to vendors.

Streaming Video and Esports. Monsarrat’s games, because they happen in the real world with real players, will make visceral, engaging video content for streaming services like Twitch or YouTube Gaming.

Telecoms. Monsarrat’s games can be used to showcase the phones, wireless data services, or edge computing services of a telecom like Verizon or T-Mobile. Monsarrat could offer a limited-time exclusive, initially launching on just one brand of smart phone, and could honestly say “works best on Verizon” in advertisements (or T-Mobile or other vendor), through a partnership where Monsarrat would work with that telecom to specially optimize the game.

Recommendation

If Monsarrat’s thesis is right, outdoor gaming could join PC, console, mobile, VR, and other game platforms as a primary channel for video games.

It would be driven by:

The global crisis of loneliness, where players yearn to go outside,

Those who feel shut out of sports, for whom Monsarrat’s games are a more creative, less athletic alternative,

The biological effect of walking outside, which lifts mood and encourages repeat play without needing an endless series of fresh content to be built to retain players,

Monsarrat’s technology supporting the most popular PC game genres with the strongest economics outside, locking out competitors with its patents,

The convenience of Monsarrat’s games, which have no fixed locations – play anywhere, even in small spaces,

The dramatically greater appeal of real world friendship and community compared to online, and

The wide array of target industries that could partner with and become an exit for Monsarrat.

With 6 patents, support from journalists, and an all-star team including a founder who previously co-invented a major video game category, Monsarrat may create another new category of video game, with unicorn potential.

Although we obtain information contained in our newsletter from sources we believe to be reliable, we cannot guarantee its accuracy as they are public sources. The opinions expressed here in the Focus on Risk Silicon Valley newsletter are ours, our editors and contributors and we may change without notice at any time. Any views or opinions expressed here do not reflect those of the organization as a whole. The information in our newsletter may become outdated in time and we have no responsibility or obligation to update it. Additionally the information in our newsletter is not intended to represent individual investment advice and nothing herein constitutes investment, legal, accounting or tax advice. No recommendations to buy, sell or hold are being made rather we intend to express what opportunities are in the market at any point in time. Rather it is for informational purposes.

No recommendation or advice is being given as to whether any investment is suitable for a particular investor or a group of investors. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. We strongly advise you to discuss your investment options with your financial adviser prior to making any investments, including whether any investment is suitable for your specific needs.

The information provided in our newsletter is private, privileged, and confidential information, licensed for your sole individual use as a subscriber. Focus on Risk reserves all rights to the content of this newsletter. Forwarding, copying, disseminating, or distributing this newsletter in whole or in part, including substantial quotation of any portion of the publication or any release of specific investment recommendations, is strictly prohibited.